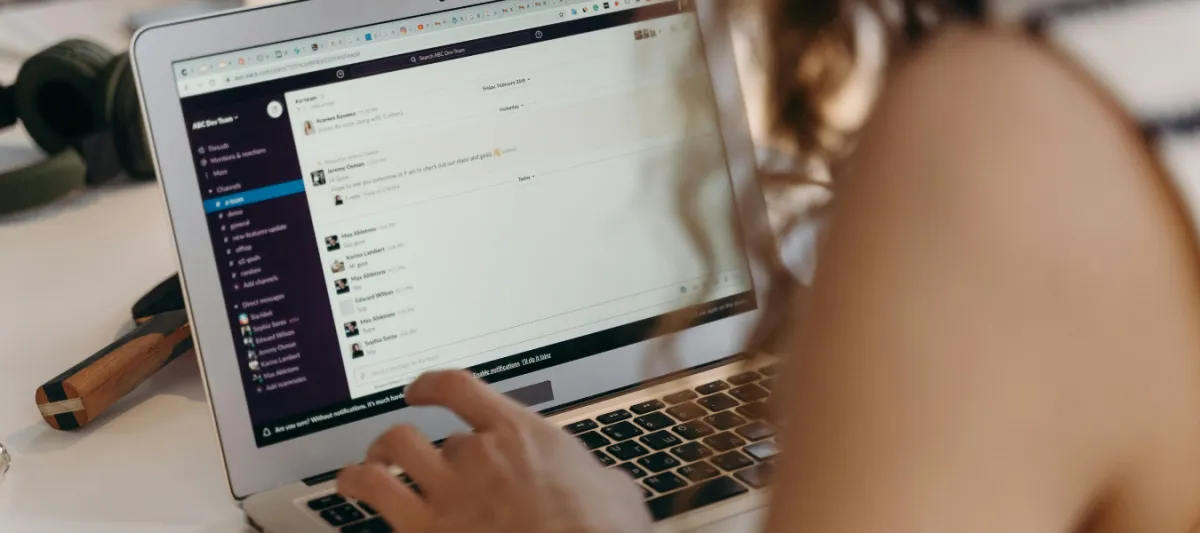

Plan for Long-Term Care Today!

Protect Your Family, Your Savings, and Your Peace of Mind”

A few minutes today can save years of stress tomorrow. Start your free assessment now.

Why Planning Matters

Did you know…

If you or a loved one already needed care

- An advisor can help analyze current or past costs of home health care, assisted living, or nursing homes.

- They can review your insurance policies and government benefits to ensure you’re maximizing available resources.

- They provide strategies to manage and protect your assets so care needs don’t drain your finances.

If you haven’t faced care needs yet

- Planning early can save you and your family from financial stress later.

- An advisor can assess your risks and recommend savings or insurance options.

- Early planning brings peace of mind, knowing you’re prepared.

If you prefer care at home

- Understand the true costs of in-home care services.

- Consider potential home modifications needed for care.

- Explore budgeting and financial support options for long-term in-home care.

If you prefer assisted living or nursing home care

- Get insight into the real costs of different facilities.

- Compare facilities and evaluate financial implications.

- Use strategies to fund care with insurance, savings, or other resources.

If you would rely on savings, investments, or retirement funds

- Learn the most tax-efficient ways to liquidate assets for care costs.

- Discover strategies to protect what remains so it lasts longer.

- Explore alternatives like long-term care insurance or reverse mortgages.

If you’re interested in tax incentives

- Take advantage of government programs that reduce long-term care costs.

- Incorporate tax incentives into your overall financial plan.

- Get a comprehensive review to maximize available savings and resources.

If you’re not interested in tax incentives right now

- Advisors can still provide valuable resources and planning strategies.

- Get advice tailored to your unique financial situation and goals.

- Plan for unexpected healthcare costs so you’re never caught off guard.

Take Your Free Long-Term Care Assessment

This takes less than 2 minutes and your answer remains confidential.

🎁 Bonus: Complete the survey today and be entered to win a $100 gift card to your choice of LongHorn Steakhouse, Conifer, or HAVANA Tropical Grill.

Return before January 20th, 2026 to qualify.

Here’s What You’ll Get After Your Assessment:

You’ll receive an email with insights based on your answers.

You’ll receive an email with insights based on your answers.

You’ll have the opportunity to schedule a free consultation with Rebecca to review your options.

Meet Rebecca, Your Long-Term Care Specialist.

Rebecca Schriver has learned how to help those around her by sitting at their dinner tables and listening to their needs. As a licensed insurance agent, she has guided clients to find the best solutions for the challenges they faced — and those they might face in the future.

Over the past four years, she has focused on Estate Planning, Tax Mitigation, and Long-Term Care. Rebecca’s goal is not only to educate clients about preparing for the future but also to craft a personalized plan to achieve it.

When her father died unexpectedly, her family was left to pick up the pieces without any plan in place. That experience drives Rebecca’s passion to ensure her clients’ families never go through the same hardship.

Today, Rebecca is an independent business owner helping pre-retirees and retirees put a plan into action for their estate, income, healthcare, and insurance needs. She is also a national speaker and educator who calls Northwest Arkansas home.

She works with individuals, couples, and business owners to build financial and legal confidence, creating a retirement with less stress and more peace of mind. Her expertise includes estate planning, retirement income planning, tax-mitigation strategies for Social Security benefits, Medicare plans, asset protection, and capital gains mitigation.

When Rebecca isn’t caring for her clients, she enjoys time with her husband and four children. She also loves hiking, fishing, and cheering on the Razorbacks — “Go Hogs!”

Understand Your Options

Know the true costs of care before you need it.

Plan Smarter

Use tax incentives and strategies to save more.

Live Confidently

Enjoy today knowing tomorrow is protected.

CONTACT INFORMATION :

Phone : 479-717-5110

Email : [email protected]

Address : 158 E Sycamore Street, Fayetteville, AR 72703

Any information provided may result in contact by a licensed insurance agent. This campaign is administered through CSI Financial Group.